Corporate Governance Report

Corporate Governance has been at the centre of academic and professional discussions since a few decades, and now, it is evident that it is increasingly important to embrace the best governance practices. In fact, it has been demonstrated more than often that during dire moments like the current Covid-19 pandemic that the companies which operate with strong governance frameworks are the ones which are more likely to make it through the storm.

The Board of Directors of the bank is fully cognizant of the above and has thus always been committed to attaining and sustaining high standards of corporate governance with the objective of enhancing shareholders’ value while also improving the service and benefits to stakeholders at large.

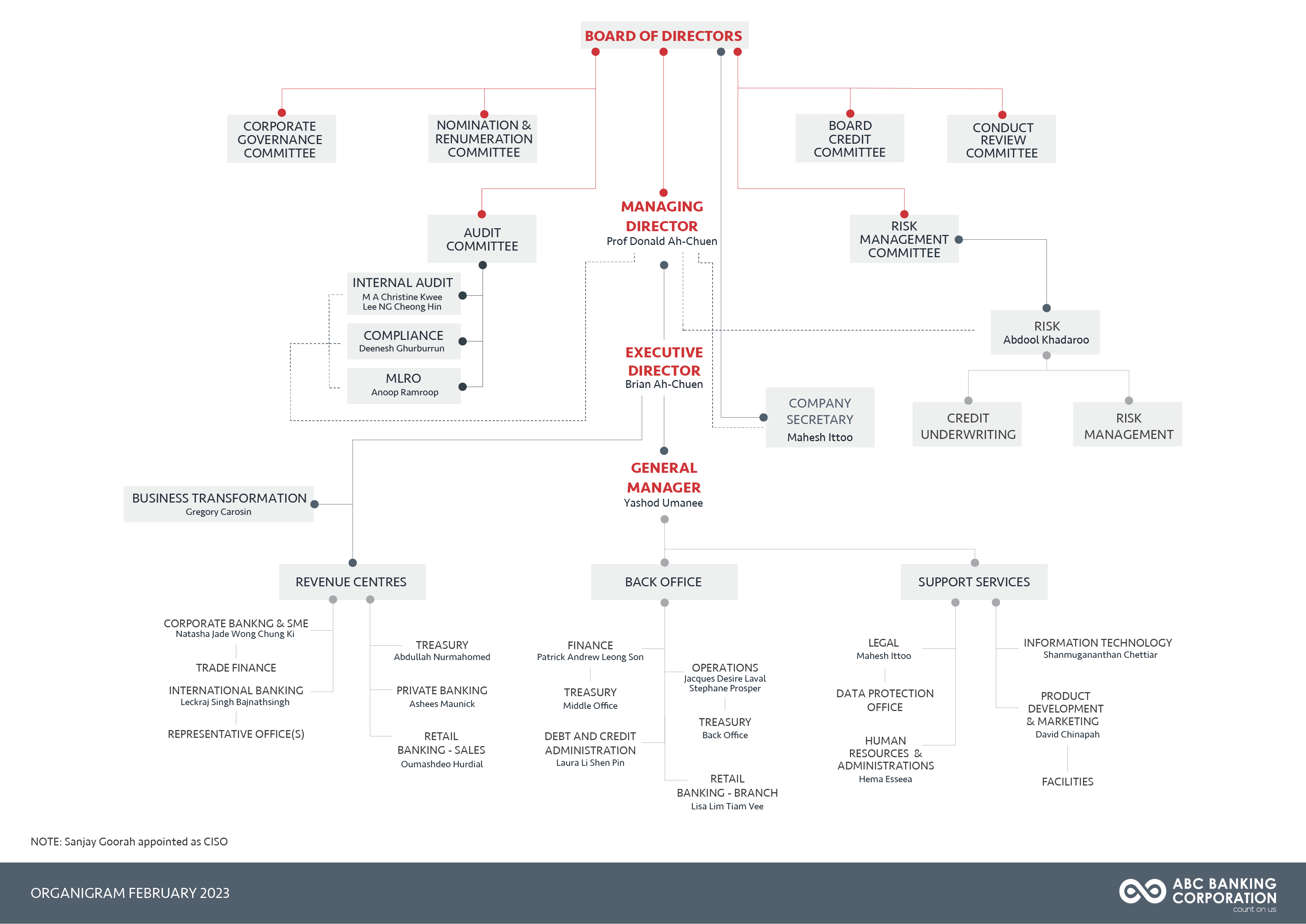

Our Governance Framework

Our Framework has been designed and built such that it becomes the system of rules and practices by which our Board of Directors ensures accountability, fairness, and transparency in the Company’s relationship with its stakeholders. Moreover, the Board views the Framework serves as the supporting structure to entity management and compliance by providing the trunk from which the various branches of compliant operations can grow and flourish.

The below diagram depicts the bank’s Structure Chart provided by the Framework:

The Board and its Role

The Board of Directors, being the mainframe of the organisation, has set up a governance framework which it deems appropriate to enable the organisation achieve its business, strategic and social role. The Board of Directors has set up a set of parameters, systems and controls to oversee the efficient and ethical conduct of the operations of the bank by the management and staff while ensuring compliance with the legal and regulatory requirements.

The directors continuously review the implications of corporate governance best practices and affirm that the bank materially complies with the provisions of the National Code of Corporate Governance and Bank of Mauritius Guideline on Corporate Governance.

The bank’s Constitution provides that the Board of Directors shall consist of not less than 6 but no more than 10 directors. In accordance with the provisions of the Banking Act 2004 and the Bank of Mauritius Guideline on Corporate Governance, the Board of the bank had a maximum of 9 directors in office during the year ended 30 June 2021, of which, two were executive directors, one was a non-executive director and 6 were independent directors, including the Chairperson of the Board. The Board of Directors of the bank have always been strong advocates of Gender Diversity in the Boardroom and it has been through some very unfortunate circumstances that the percentage of female directors has decreased to 11.1%. The Board however vows to improve this ratio in the coming years. As the Board is ultimately responsible for the affairs of the bank, all the directors are appointed to serve on the Board by the shareholders of the bank at the Annual Meeting of Shareholders.

The above composition enables the Board to function effectively and independently under the guidance of the Chairperson, Mrs Ah Foon Chui Yew Cheong, Professor Donald Ah-Chuen and Mr David Brian Ah-Chuen, being the two executive directors, ensure that the policies and strategies approved at Board level are cascaded through the Organization.

Directorate:

| Directors | Category |

| Mrs Ah Foon Chui Yew Cheong | Independent Chairperson |

| Mr David Brian Ah-Chuen | Executive Director |

| Prof. Donald Ah-Chuen | Executive Managing Director |

| Mr Patrick Andrew Dean Ah-Chuen | Non-Executive Director |

| Mr Bhanu Pratabsingh Jaddoo | Independent Non-Executive Director |

| Mr Michel Bruno Lalanne | Independent Non-Executive Director |

| Mr Lakshmana Lutchmenarraidoo | Independent Non-Executive Director |

| Mr André Kwet-Tsong Tze Sek Sum | Independent Non-Executive Director |

| Mrs Laura Yee Min Wong Sun Thiong | Independent Non-Executive Director |

Board Structure and its conduct of affairs

Our Corporate Governance Framework provides that a unitary Board of Directors shall be entrusted with the necessary powers to direct and supervise the management of the business and affairs of the bank in an ethical and responsible manner in line with the Guidelines of the Bank of Mauritius and the National Code of Corporate Governance. While some of the responsibilities are discharged directly by the full Board of Directors, others are delegated to committees of the Board to ensure that appropriate attention is given that granular level. A summary of such discussions and actions points are reported by the chairpersons of the respective committees at the subsequent meeting of the Board of Directors.

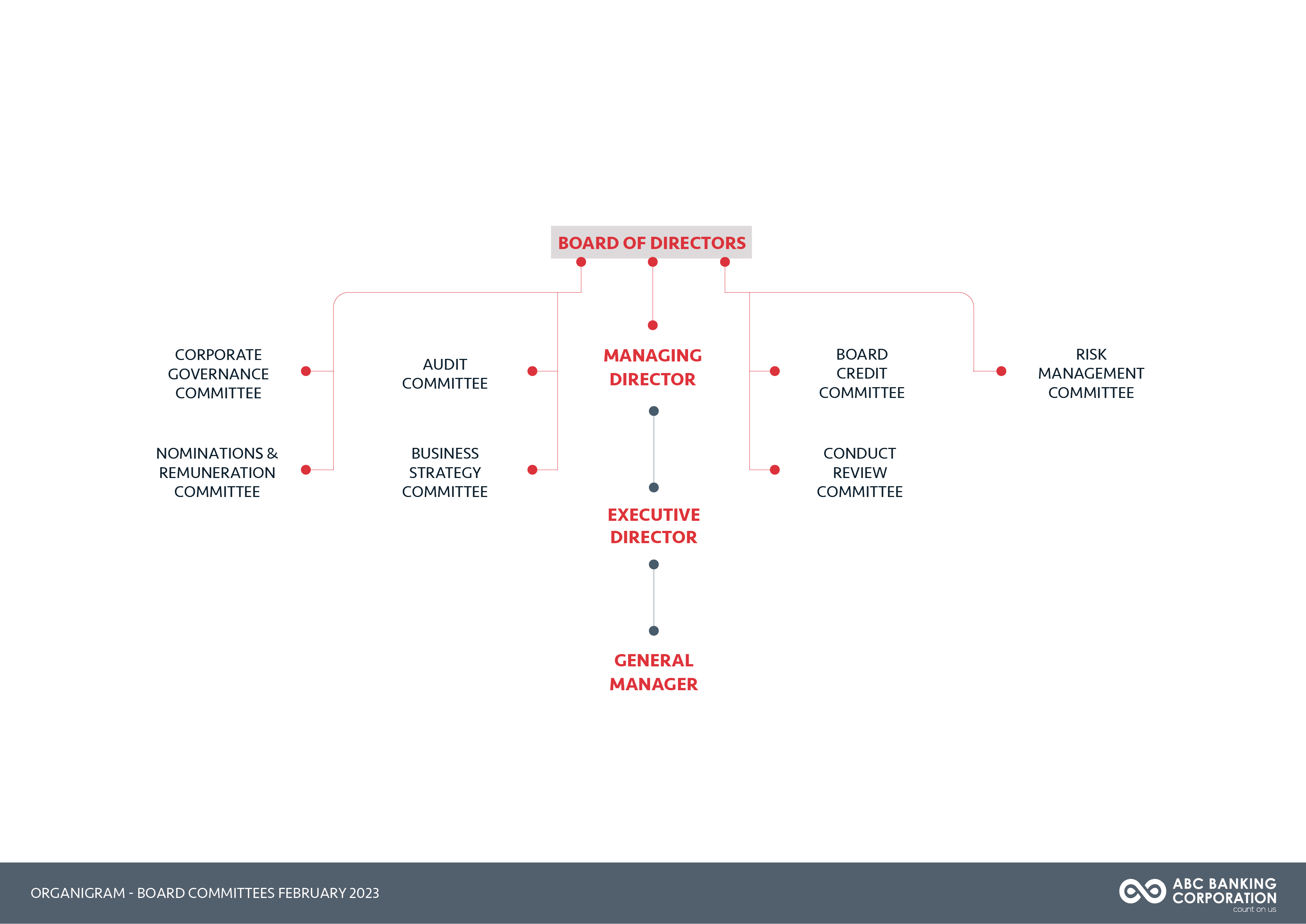

Board Committees

The Board has set up 7 committees to facilitate the effective and efficient discharge of its duties and responsibilities, namely the Board Credit Committee established as from June 2021, the Audit Committee, the Risk Management Committee, the Conduct Review Committee, the Nominations and Remuneration Committee, the Corporate Governance Committee and the Business Strategy Committee. The Company Secretary acts as secretary for all meetings of the Board of Directors and its Committees. The terms of reference and composition of the Board Committees are summarized below.

The below diagram depicts the organisation of the Board :

Every effort has been made to ensure that all information in all Program materials is accurate. We are not responsible for printing errors or omissions.

SUPERVISORY & MONITORING COMMITTEE (DISCONTINUED ON 31 MAY 2021)

The Supervisory & Monitoring Committee (“SMC”) had been delegated the responsibility of implementing and realizing the policies, strategies and directives of the bank as set out by the Board. The primary attributions of the Committee were:

- submitting to the Board the development strategy of the bank

- delegating authority to the Managing Director for the day-to-day operations of the bank and supervising and monitoring the management of the bank

- liaising with all Board committees as required

- setting out the corporate values and principal policies, including the credit policy, in respect of the conduct of the business

- reporting to the Board on the progress of the operations of the bank

Board Committee (AS FROM JUNE 2021)

The Board Credit Committee has been established by the Board of Directors of the Company and has been delegated the responsibility of considering and approving credit facilities, including placement limits with banks and financial institutions, in conformity with the provisions of the Credit Policy established by the Board.

Audit Committee

Th Audit Committee assists the Board of Directors in discharging its duties relating to the safeguarding of assets, the operation of adequate systems, control processes and the preparation of accurate financial reports and statements in compliance with all applicable legal requirements and accounting standards. The responsibilities of the Audit Committee are defined in its terms of reference and include, but are not limited to:

- reviewing the audited financial statements and quarterly results of the bank before they are approved by the directors

- ensuring that management implements and maintains appropriate accounting, internal control and financial disclosure procedures and review, evaluate and approve such procedures

- reviewing such transactions as could adversely affect the sound financial condition of the bank

- reviewing and approving the audit scope and frequency

- receiving audit reports and ensure that management is taking appropriate corrective actions in a timely manner to address and control weaknesses and identified areas of non-compliance

- satisfying itself that accounting principles, policies and practices are adequate to ensure resources are safeguarded, laws are followed, reliable data is disclosed, and internal control systems are adequate

Risk Management Committee

The Risk Management Committee assists the Board of Directors in the discharge of its duties relating to corporate accountability and the associated risk in terms of management, assurance and reporting. The responsibilities of the Risk Management Committee are defined in its terms of reference, and include, but are not limited to:

- reviewing of the principal risks, formulating and making recommendations to the Board in respect of risk management issues

- reviewing and approving discussions and disclosure of risks

- reviewing the Assets and Liabilities Committee (“ALCO”) reports

Conduct Review Committee

The responsibilities of the Conduct Review Committee are as specified in the Guideline on Related Party Transactions, and include, but are not limited to the following:

- ensuring that management establishes policies and procedures to comply with the requirements of the Guideline on Related Party Transactions

- reviewing the policies and procedures periodically to ensure their continuing adequacy and enforcement, in the best interests of the bank

- reviewing and approving each credit exposure to related parties

- ensuring that market terms and conditions are applied to all related party transactions

Nominations and Remuneration Committee

The Nominations and Remuneration Committee has been delegated the responsibility of overseeing the nomination and remuneration functions of the Board and making recommendations to the Board such matters. The responsibilities of the Risk Management Committee are defined in its terms of reference, and include, but are not limited to:

- Monitoring the bank’s succession plan

- Establishing the procedures for identification, selection and recommendation of new directors

- Establishing and monitoring the bank’s remuneration policy and recommending appropriate remuneration for directors.

Corporate Governance Committee

The Corporate Governance Committee has been established by the Board of Directors to make recommendations to the Board on all corporate governance provisions to be adopted so that the bank remains effective and complies with prevailing corporate governance principles. The Committee shall be constituted to ensure that the reporting requirements with regard to corporate governance, whether in the annual report or on an on-going basis, are in accordance with the guidelines set out by the Bank of Mauritius and the Code of Corporate Governance.

Business Strategy Committee

During the past years, the high-level of Board oversight on the operations of the bank has facilitated the fast and steady growth of the latter. Commensurate with its ambitions of making a major leap in growth, the Board has set up the Business Strategy Committee.

The Business Strategy has been set up to monitor and follow-up the implementation, control and review of the agreed strategies of the bank. The duties of the Business Strategy Committee are as follows:

- To review, and recommend to the Board for onwards approval, the strategic plan of the bank which has been prepared in accordance with the bank’s values, vision and mission whilst taking into consideration all relevant factors present in the bank’s business environment.

- To monitor the progress of the implementation of the strategic plan through the measurement of various Key Performance Indicators (KPIs) and the regular review of ongoing projects.

- To oversee the Management’s Strategic Management Framework and to review and make recommendations with respect to the management’s strategic plan for each financial year.

- To review the annual budget as proposed by Management from a strategic perspective.

Company Secretary

The Board has appointed Mr. Mahesh Ittoo as the Secretary to carry the management of corporate secretarial and governance affairs in-house.

Mr. Mahesh Ittoo is a holder of a BA (Hons) Law and Management from the University of Mauritius and a Masters in Banking and Financial Law from the University of London. He is also an Associate of the Chartered Governance Institute (ex-ICSA) and a Member of the Chartered Institute for Securities and Investment.

Mr. Mahesh Ittoo has 10 years’ experience in the corporate administration and governance field and was working in the Global Business Industry prior to joining the ABC Group in 2016. Mr. Ittoo has represented ABC Professional & Corporate Secretarial Services between 2016 and 2020 before being appointed as the Company Secretary of ABC Banking Corporation Ltd as from 1 September 2020.

The Company Secretary is responsible for the organization of Board and Committee meetings and acts as a bridge between executive management and the non-executive board members. The Company Secretary also oversees all governance matters at the bank and is the link between the bank and its shareholders.

Key Activities of the Board

Strategic Planning and Monitoring

The Board of Directors is responsible for setting the ultimate direction for the bank. Like all large organisations, at the bank, the initial strategy is developed at executive level following an assessment of the issues, opportunities and risks that drive performance in the current market and in line with the bank’s risk tolerance, capacity and appetite. The role of the Board in the strategic planning process entails the identification of priorities, establishment of goals and objectives, finding resources, and allocating funds to support the decisions that need to be made around strategic planning. The Board is also responsible for monitoring the execution of the strategic plan. This requires the Board to oversee the implementation of the strategic plan and as the plan progresses, the Board considers whether there is a need to revisit the allocation of funds as well as the applicability of certain projects. At the bank, strategic management is not just another cyclical task, it is a dynamic and continuous exercise. Whilst the executive team has been tasked of the implementation of the strategic plan, the Business Strategic Committee has the responsibility to oversee and monitor the implementation of the plan on a half yearly basis. Over and above the works of the Business Strategy Committee, the Board as a whole, on a quarterly basis, questions, challenges and clarifies the plan submitted by management to ensure that plan is well thought out, realistic, market-appropriate and compatible with the organization’s mission, vision and values.

Succession Planning

The Board highly rates the importance of a succession plan being in place at the bank as it is the component of the governance framework which helps to avoid any disruption in case of unplanned departure of any director or senior officer. The Nomination and Remuneration Committee has been delegated the task by the Board to regularly assess the situation at Board and Management levels and to ensure that appropriate coverage action can be taken at all times to fill any gap in regard to all key positions at the bank.

The succession plan is reviewed on at least on a quarterly basis and any update to same is tabled at the Nomination and Remuneration Committee as and when required.

Appointment of new Directors and Senior Officers

Over and above the requirements identified by the Succession Plan, as part of its mandate, the Nomination and Remuneration Committee also continuously assesses the balance of skills and experience required at Board level, and whenever the need for a new/additional member is required, the following process is rigorously followed:

- A profile of the best candidate is prepared, specifying the necessary skills and experience required for the position.

- Prospective candidates are identified by the Committee or a consultant.

- Should there be more than one candidate, the profiles of prospective candidates are transparently vetted by the Committee and each shortlisted candidate are interviewed by the members of the Committee or an appointed panel.

- Once a prospective candidate has been selected, his/her appointment will be put forward to the Board of Directors for appointment. In the case of a director, the appointment shall be up to the next Annual Meeting of the Shareholders, whereby he shall present for election. Appointment of any director or senior office at the bank is subject to approval by the Bank of Mauritius.

Once a prospective non-executive director has accepted a seat on the Board, he/she is requested to sign a letter of appointment which carefully outlines the terms of appointment, the duties and responsibilities expected by him/her.

All new directors are, upon their appointment, invited to participate in an induction session whereby, the Managing Director and the Company Secretary shall introduce the Company to the new director. The incoming director is provided with all necessary information he/she needs to fulfil his/her role and duties as director of the bank.

All directors of the bank have participated in an induction session upon appointment.

Board Evaluation and Remuneration

In line with the National Code of Corporate Governance and Bank of Mauritius Guideline on Corporate Governance, the Board has established a mechanism to evaluate the performance of the Board, its committees and its members. The review and evaluation include an assessment of the Board’s composition and independence, performance and effectiveness, as well as the maintenance and implementation of the Board’s governance, relationship with management, with the addition of an evaluation of the sub committees. The Nominations and Remuneration Committee was delegated the task of conducting such appraisal to identify additional competencies and resources as appropriate and enable the Board to discharge its responsibilities more efficiently and effectively. Such a process also aids the Board to identify and deal with issues that impede its effectiveness. The “fit and proper person” criteria of Board members are also reviewed periodically to ensure that the same are up to date.

The Nominations and Remuneration Committee has also delegated the task of conducting periodic reviews of the above process to ensure that same be always in line with the applicable legislations and regulations.

Approval of Remuneration Policy

In compliance with the National Code of Corporate Governance and Bank of Mauritius Guideline on Corporate Governance, the Board has established a Remuneration Policy to establish clear and guiding principles for decisions around employee and executive remuneration to ensure fair, competitive and appropriate pay for the market in which the bank operates.

The bank’s goal is to ensure that the mix and balance of remuneration is appropriate to attract, motivate, retain and reward employees fairly and is consistent with the National Code of Corporate Governance.

Risk Governance and Internal Control

Risk management refers to the process by which the bank monitors and mitigates its exposure to risk. At the bank, risk management is not viewed as an exercise seeking to identify and eliminate all risks, but rather, it involves a comprehensive approach consisting of the identification and assessment of all potential risks in the banking business, the development and execution of an action plan to deal with and manage these activities that incur potential losses, and, the continuous review and reporting of the risk management practices after implementation. All of these need to be carried within a risk appetite framework.

The Board has established a risk appetite framework where its business objectives are articulated in contrast with the level of risk it is willing to assume to achieve its targets. The framework offers a platform for the Board of Directors to be actively engaged in the improvement of risk governance and discussion of risk from a strategic point of view. The clear definition of risk tolerance and desired risk profiles helps cascade the risk strategy approved by the Board to individual business unit levels.

While the Board is responsible for the overall risk management and internal control systems, oversight of the bank’s risk management process has been delegated to the Risk Management Committee. The Risk Management Committee in turn appoints a Head of Risk who is responsible for overseeing the risk management and internal control functions on a daily basis and he reports to the Risk Management Committee on a quarterly basis on key risk matters for discussion, and material matters are then reported to the Board by the Chairperson of the Risk Management Committee.

The risk management framework, including policies and systems in place, ensures a systematic and continuous identification and evaluation of risks and actions to terminate, transfer, accept or mitigate each risk to achieve a prudential balance between the risks and potential returns to shareholders is explained in the Risk Report. Identification of key risk areas and internal control systems in place are also addressed.

Internal Audit

The Board recognizes the importance of having a robust internal audit function at the bank to provide assurance, through continuous, independent, and internally organized detailed checks and assessment, that the bank’s risk management, governance and internal control processes are operating effectively, and, an Internal Audit Section has been set up at the bank accordingly. The Internal Audit Section comprises of auditors with a mix of banking and auditing experience who are able to assess the current state of affairs and provide valuable recommendations to management.

The Internal Audit function provides assurance to the Board on the overall effectiveness of the governance, risk management and internal control framework at the bank. In line with The National Code of Corporate Governance for Mauritius (2016), the Board delegates oversight of the internal audit function and responsibility for receiving internal audit reports to the Audit Committee. Internal Audit reports are considered at Audit Committee meetings which are held on a quarterly basis, and the Head of Internal Audit has ready and regular access to the Chairperson of the Audit Committee. The Audit Committee also approves the Audit Plan at the beginning of each new financial year to ensure proper coverage of the bank’s key risk areas/ activities by Internal Audit. The Head of Internal Audit adopts a systematic and disciplined approach to review all areas of activity of the bank, i.e. operations, internal controls, risk management systems, and governance process, and makes recommendations accordingly to management. The internal audit reports highlighting the methodology, findings, recommendations and management responses are tabled on a quarterly basis at Audit Committee meeting. The scope of action of the Internal Audit has no restriction to any aspect of the bank.

The Audit Committee is also responsible to provide ongoing feedback and guidance to internal audit to help it provide the assurance service that it needs. Reviewing internal audit reports helps the Audit Committee to assess the quality of internal audit’s work during the course of the year. As part of annual review by Audit Committee, feedback may also be obtained from senior management, management and external auditors.

To ensure the independence of the Internal Audit function, the Head of Internal Audit is appointed by the Audit Committee and directly reports to the latter while reporting only administratively to the Managing Director as illustrated in the Organigram on page 7. The Head of Internal Audit also has direct access to the Chairman of the Audit Committee and has regular meetings with him.

Ethical Conduct

The bank is committed to the highest standards of business integrity, transparency and professionalism and ensures that all its activities are managed responsibly and ethically whilst seeking to enhance business value for all stakeholders. In line with this objective, the bank has put in place a Code of Conduct and Ethics which clearly reveals the core values which the bank stands for and the standard of dealings that the public at large can uncompromisingly expect. This code is designed to help employees at all levels to understand their responsibilities and to carry out their duties with due diligence, honesty and integrity, which are fundamental to the reputation and success of the bank. The bank also has in place an anti-fraud policy to encourage employees to freely communicate concerns about illegal, unethical or questionable practices to senior management or the Head of Internal Audit without fear of reprisal. Other bank policies are also in place to ensure against improper use of the bank’s property and/or information, unfair dealing with customers/clients, employees and other stakeholders.

During the Financial Year ended 30 June 2021, the Board has revised the Code of Ethics for Staff and has adopted a new Code of Ethics for directors. The latter document was reviewed by the Corporate Governance Committee and has been adopted by the Board to ensure that the bank complies with the Code.

Workshops have been organized for all staff to ensure that they are apprised of the contents of the Code of Ethics and of the consequences of non-compliance. The document has also been published on the website of the bank.